Venture Rollups: An Emerging Asset Class

How AI, abundant capital, and a Constellation-inspired playbook are rewriting the rules of company building in certain sectors. Thoughts & perspectives by Bifrost Studios.

Introduction

“Venture rollup” is possibly an unfamiliar term or may sound like an oxymoron to some readers, although it merely references the intersection of Venture Capital (Venture) and Private Equity’s favorite value creation strategy (Rollups). Venture investors usually back founders who build something from scratch; roll-ups traditionally belong to private equity. In 2024-25 a hybrid has emerged:

Venture rollups are tech-first companies that scale primarily by buying profitable businesses, then inject proprietary software or AI agents to raise margins and growth. They finance the spree with venture equity first, moderate leverage second, and target 10-20x returns.

Venture rollups mix high-multiple equity with low-multiple acquisitions, often supplemented by debt, to arbitrage value. This capital strategy aims to deliver private equity levels of risk with a venture-like upside potential. Low-multiple acquisitions often encompass sub-scale firms, which leads way to another term used in this space - micro private equity.

In layman terms, the aim is to build enterprise value by acquiring multiple smaller businesses at low multiples, applying new technology and operational efficiencies to a degree that essentially re-invents the acquired companies, and eventually achieving a higher combined valuation.

I’ve come across two narratives to the concept:

A tech-forward, new-built venture that leverages M&A and debt to inorganically capture market share.

A private equity actor with a rollup playbook also applying extraordinary levels of technology and transformation to the acquired firms resembling the venture way.

Regardless of the angle that resonates most, the concept concerns the intersection as an emerging hybrid asset class with compelling properties.

You could think of it as Constellation Software meets Y Combinator, seasoned with a dash of KKR.

A Recap of Actors in the Landscape

While likely familiar territory to most, a brief note on the moving parts and actors in the landscape seems appropriate.

Modern Holding Companies

Mark Leonard’s Constellation Software is the prime example. It has acquired more than 1.000 vertical-market software businesses, rarely sold any of them, and compounded revenue at roughly 30 percent a year for three decades. Its secret sauce is extreme decentralization: tiny operating units keep their own P&Ls while headquarters focuses solely on capital allocation.

Tiny with Andrew Wilkinson at the helm adopts a similar “permanent capital” playbook for bootstrap-friendly, “wonderful” internet brands. Tiny buys profitable SaaS or e-commerce properties at 3-6x EBITDA, leaves founders in place, and pays out excess cash as dividends. Think of Tiny as Constellation’s lifestyle-business cousin - smaller deals, less formal governance, same long hold horizon.

Traditional Private Equity

Private equity roll-ups date back to the 1980s, when pioneers like KKR and Brad Jacobs used leverage to consolidate regional funeral homes and waste-management firms. The formula was simple:

Buy multiple small cash-flowing businesses at low multiples.

Layer on debt that is serviced by those cash flows.

Strip costs or standardize purchasing to lift EBITDA.

Exit to a larger PE fund or strategic buyer at a higher multiple.

The risk profile is asymmetric: if interest rates spike or integration fails, equity is wiped out; if all goes well, 3-4x returns arrive within five years.

Venture Capital

Traditional VC shunned heavy M&A for most of its history. The explosive venture path was:

Start with zero revenue.

Achieve product-market fit.

Scale with near-infinite gross margin.

Rely on a power-law outlier to carry the fund.

Acquisitions were considered a Series D luxury (Facebook-Instagram, Google-YouTube) or a way to hire talent. Roll-ups felt too operational, too debt-heavy, and too slow for the upside VC demanded.

Venture Studios

Venture studios like Idealab, Rocket Internet, and Atomic take a founder-in-a-box approach. They generate ideas in-house, assemble founding teams, and own a large equity stake in each spin-out. While studios usually build from scratch, several now incorporate micro-M&A to accelerate traction - blurring the line between studio incubation and roll-up execution.

Why now? Tailwinds & Trends

The buy-and-build playbook has existed for decades, but 2024-25 delivers a unique alignment of technology, demographics, and capital markets that makes a venture version newly attractive.

AI turns services into Service-as-Software

Past decades of automation sped human work; large language models are starting to replace it outright. Foundation Capital values the prize at $4.6 trillion in annual services spend that could be captured by AI-first operators rather than software vendors.

Margin follows whoever owns the customer relationship. Buying the service provider - an accounting firm, call-center outsourcer, or HVAC contractor - and installing AI agents can be cheaper and faster than selling those agents one license at a time. In essence, tech can now transform low-multiple service cash flows into high-multiple software cash flows.

The Great Succession

The US has 2.3 million baby-boomer-owned businesses that will seek an exit before 2030. Most generate steady cash, under $5 million EBITDA, and command 3-5x EBITDA sale multiples. Fragmentation is extreme: HVAC, dental, pool services, accounting, and staffing each have tens of thousands of sub-scale independents.

For rollup founders this is a once-in-a-generation supply glut of motivated sellers who value certainty of close over top-tick price.

Capital looking for real assets

Venture firms closed record funds in 2021-22 just as the exit window slammed shut. US-focused VC vehicles now sit on $277-312 billion in unused capital - the highest real‑dollar overhang on record according to the Financial Times.

Late-stage GPs still need to write $50-100 million checks, but pure software deals are scarce and priced for perfection. Tech‑enabled rollups let them deploy sizable capital into assets with immediate cash flow while preserving a software‑style narrative.

Private credit boom

Direct-lending AUM passed $1.8 trillion in 2024 according to Reuters. Fierce competition has already repriced 50+ unitranche loans this cycle, pushing average spreads down to SOFR + 514 bps - about an 11.2 percent all-in coupon according to PitchBook.

When you can buy EBITDA at 4.5x and borrow at 11 percent, even modest tech-driven margin lift produces handsome equity IRRs. Just as important, private-credit lenders are comfortable underwriting asset-light companies as long as the rollup controls sticky customers and recurring revenue.

Debt, risk, and the democratization of leverage

In the 1990s a lender asked for hard collateral: inventory, machinery, real estate. By 2010 subscription-based SaaS opened the door to ARR-backed lending; by 2023 private-credit funds were underwriting cash-flow loans to pure-software companies with no physical assets at all. This shift - combined with low interest rates through 2021 - lowered the barrier for service and software firms to use moderate leverage without pledging hard assets.

Talent rebalancing

From 2018-2021 Big Tech and high-growth startups vacuumed up every product manager, data scientist, and MBA who could spell “TAM.” That wave crested in 2022. As FAANG hiring freezes, venture layoffs, and slower IPO pipelines set in, thousands of mid-career operators started asking a new question: “Where can I run an entire P&L, not just a feature team?”

Several forces are converging:

For venture roll-ups, this “talent overflow” solves a chronic private-equity pain point: finding CEOs willing to run sub-scale businesses at reasonable comp. Today an ex-Stripe product lead might happily take a $200K salary plus 10 % equity to modernize a $4 million-revenue pool-service platform - especially if she can wield AI tools that 10x operational leverage.

Capital is no longer the scarce ingredient - qualified operators are. 2025’s talent rebalancing delivers exactly that, giving roll-ups a deep bench of tech-savvy, ownership-hungry leaders ready to transform Main Street businesses into data-driven platforms.

The venture gold rush pauses, capital hunts for a new home

Zero-interest-rate policy fueled the 2020-2021 venture boom: record fundraising, sky-high multiples, and an arms race for talent. When rates jumped in 2022, software multiples compressed by more than 50 percent and late-stage deal flow dried up. The result: hundreds of billions in dry powder now sit on VC balance sheets looking for safer ways to earn a return.

Tech-enabled roll-ups - backed by real cash flow yet promising tech-like upside - have become the new frontier.

Anatomy of a Venture Rollup

Market Filter

Sectors scoring 4/4 are ripe for an efficient roll-up.

The Transformation Stages

Repeat for each add-on; compounding operational know-how is what ultimately drives multiple expansion. Naturally, the secret sauce and value is derived in the integration and transformation of the acquired companies.

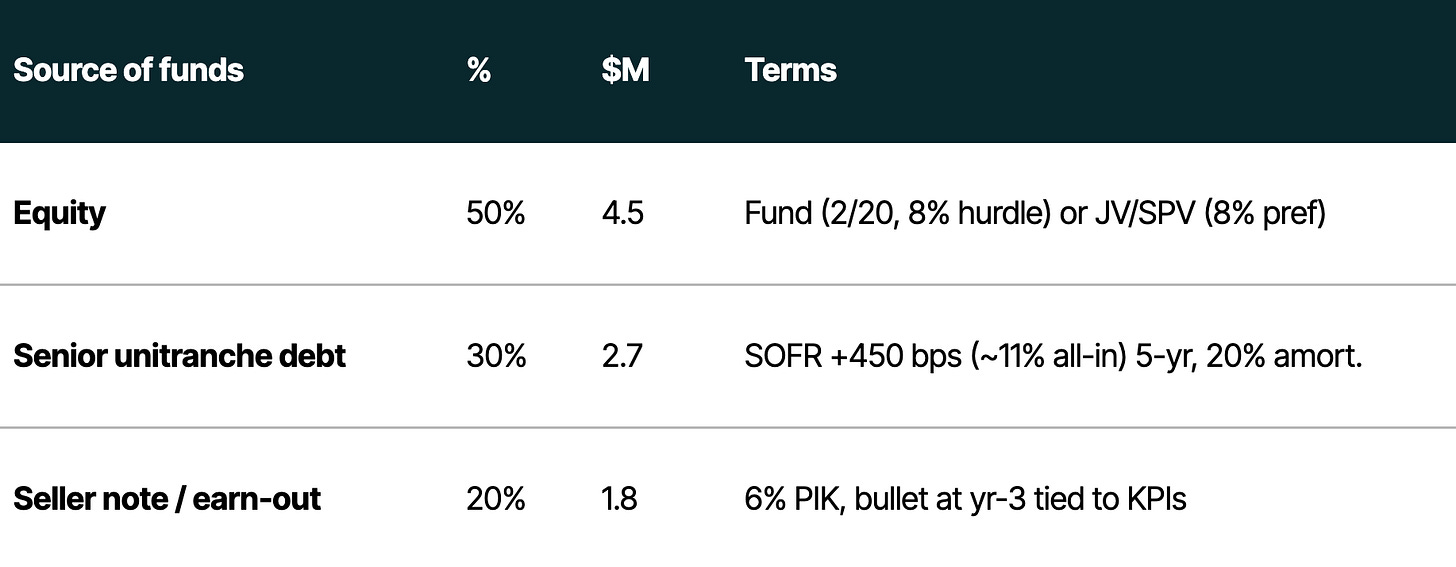

Capital Stack Math - example

Target: Regional HVAC contractor

EBITDA: $2M

Purchase multiple: 4.5x

EV: $9M

Post-close tech lift: AI route optimization adds 25% to EBITDA (→ $2.5M).

Exit multiple: Blended platform re-rates to 8x → EV ~$20M.

Equity value at exit: EV - net debt - seller note payoff ≈ $15M → 3.3x cash-on-cash in ±36 months (≈ 43% IRR).

Venture M&A Pioneers - Case Studies

Metropolis - computer-vision parking empire

Founded in 2017 by serial parking entrepreneur Alex Israel, Metropolis began as a pure software company: computer-vision hardware and payments rails that let drivers “drive in, drive out” with automatic billing. After struggling to convince entrenched lot operators to rip out legacy kiosks, Metropolis flipped the script and became an operator itself. In October 2023 it raised $1.7 billion (equity + debt) and took SP Plus private, instantly acquiring 3.500 facilities across 40+ markets.

Playbook

Anchor acquisition - SP Plus delivers scale and locked-in CV deployments.

Tech overlay - install vision hardware, dynamic pricing, and route-planning to lift rev-per-stall (Metropolis claims +20 percent six months post-install).

Add-ons - Premier Parking (2022) and a pipeline of municipal garage carve-outs extend local density.

Monetize platform - open B2B API so third-party lot owners can license the CV stack.

The upside is massive: every successful install turns a low-margin parking box into a yield-optimized fintech node.

Teamshares - employee-owned Main Street at scale

Teamshares (NYC, 2019) buys “boring but profitable” SMBs from retiring owners - think machining shops, insurance brokers, niche manufacturers. Purchase price averages $2 million; 89 acquisitions closed as of Q1 2025. On day one employees receive 10 percent stock, ramping to 80 percent over 20 years, while Teamshares layers fintech products (payroll, 401k, insurance) across the network.

Playbook

High-volume sourcing - proprietary seller funnel, 90% LOI-to-close vs ≈6 percent on BizBuySell.

Succession swap - install a new president, keep culture intact.

Fintech attach - payroll and insurance subscriptions drive 125 percent NRR on early cohorts.

Hold forever - no flip; long-run liquidity via IPO as “the American ESOP index”.

Teamshares reframes roll-ups as stakeholder capitalism: investors earn through fintech, employees build wealth through ownership.

PipeDreams - wiring HVAC with software

PipeDreams (SF, 2020) targets residential HVAC, plumbing, and drain-cleaning shops - an $80 billion, hyper-fragmented sector. Backed by $25.5 million Series A (Canvas & Plural, 2024) it has closed 9 acquisitions across six states.

Playbook

Identify top-quartile operators (>$2.5M rev, 10+ techs) at 3-5x EBITDA.

Install field-ops SaaS - scheduling, inventory, flat-rate pricing. Result: first-time-fix rate jumps from 63 percent to 81 percent.

Centralise marketing - pooled SEM lowers CAC ≈25 percent.

Expand trades - add electrical, then bundle homeowner financing.

Aim: national “Super-Regional” home-services brand with PE-backed exit optionality or IPO.

Accrual - Cosmin Nicolaescu’s AI accounting rollup

Accrual is the brainchild of ex-Brex CTO Cosmin Nicolaescu. Seed-financed with $16 million (Thrive, General Catalyst, 2025) it plans to buy accounting practices at 6-7x EBITDA.

Playbook

Phase 1 (Year 0-1). Automate bookkeeping and reconciliation with internal LLM agents; cut labour 30 percent.

Phase 2 (Year 1-3). Layer predictive tax planning, real-time dashboards; upsell CFO-as-a-Service.

Phase 3 (Year 3-5). Rebrand network under one national firm, refinance with private credit, then IPO or sell a minority stake.

Goal: create the “RSM 2.0” of mid-market accounting with AI margins closer to software than professional services.

Commons Clinic - value-based orthopedics

LA-based Commons runs outpatient orthopedic and spine centers. With $33.5 million raised, it acquires minority stakes or full control of ASC-licensed clinics. Value prop: AI-driven outcome tracking lets it negotiate shared-savings contracts with insurers.

Playbook

Acquire or JV with top surgeons.

Centralize EMR & analytics to benchmark outcomes.

Bulk-buy implants and supplies for 12 percent COGS reduction.

Value-based contracts give upside when recovery times beat benchmarks.

Healthcare regulation is a moat; tech unlocks payer economics.

Cabana - pool-service land-grab (previously Splash)

Cabana (re-branded from Splash in 2025) eyes the 85.000-company, $5 billion residential-pool market. Seeded with $4.5 million (Asymmetric Capital) it’s targeting 200 acquisitions by 2028.

Playbook

Cluster strategy - buy dense routes in Sunbelt metros at 3-4x EBITDA.

Route optimization and IoT sensors cut truck-roll time 18 percent; chemical usage falls 12 percent.

Unified brand & subscription model - flat monthly fee, in-app booking.

Supply-chain leverage - bulk chemical purchasing boosts gross margin 8 points.

Vision: the first national consumer brand in pool care, with optional adjacencies in lawn and outdoor-living services.

AI-native rollups - Rocketable and the one-person billion-dollar company

“We are building a large portfolio of wildly profitable software businesses by acquiring existing products and replacing humans with AI agents.” - Rocketable mission statement.

Rocketable’s thesis: every box on a SaaS org chart can be mapped to a specialized agent. Marketing agent drives ad creative and bid optimization. Support agent handles Tier 1 tickets and updates the knowledge base. Product agent triages backlog and drafts specs. Finance agent invoices, predicts churn, and manages cash. If all agents report to a shared goal layer, a single human could oversee an entire portfolio.

Playbook

Acquire SaaS with $1-5M ARR at 3-4x ARR multiples.

Agentify every repeat workflow; humans move to oversight.

Benchmark: release velocity up, CAC down, NPS flat or better.

Scale to larger deals; eventually run dozens of products with < 50 staff.

The Bear Case

Multiple drag. Blend too much 30 percent-margin service revenue and the SaaS multiple collapses.

Leverage shock. Rates up 300 bps can wipe equity.

Agent brittleness. An AI bookkeeping agent that invents figures could trigger malpractice.

Talent clash. Bay-area PMs may revolt when asked to manage plumbers at 5 AM.

FTC scrutiny. Serial dental or insurance acquisitions could face forced divestitures.

Exit window. IPO markets for holdcos remain thin; continuation funds or dividends may be needed.

Will venture rollups earn a permanent slot in the asset class spectrum?

Constellation proved buy-and-build can create 70 billion dollars with minimal leverage. Thrasio proved leverage without integration discipline can vaporize billions. Venture rollups of 2025 sit between those poles. If Rocketable’s agents really do run an autonomous SaaS stack, or if Accrual triples partner productivity, the dam breaks and rollups graduate from curiosity to core strategy.

The next 24 months - integration KPIs, agent uptime, credit spreads - will show whether venture rollups become an enduring asset class or a clever footnote in the history of venture experimentation.

Follow along as we at Bifrost Studios share our execution of our micro private equity and venture rollup strategy, and the learnings we make along the way.

Love this take. Have written a few posts on these (i call them venture buyouts) :-)